income tax calculator philippines

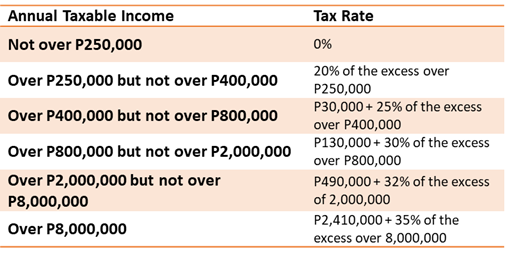

Net taxable compensation and business income of resident and non-resident citizens resident aliens and non-resident aliens engaged in a trade or business are consolidated and taxed at the above rates. 6 rows The Tax tables below include the tax rates thresholds and allowances included in the.

Montenegro Individual Taxes On Personal Income

This tool is built so more Filipinos are.

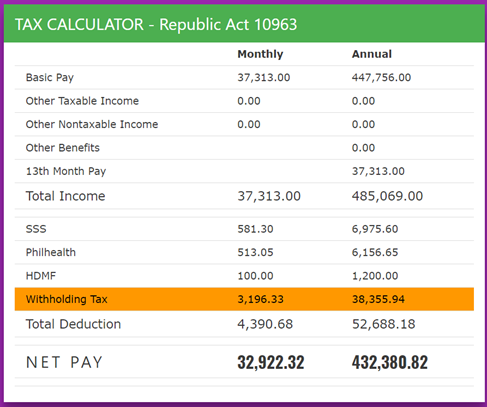

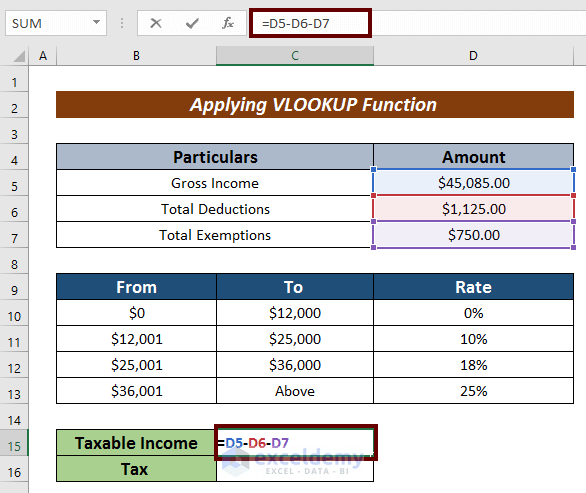

. If taxable income for the year for example resulted to 1000000 tax due will be 190000. The calculator uses the latest SSS Contribution Table 2021 for the computation. To compute your taxable income follow this formula.

For non-resident aliens engaged in a trade or business in the Philippines dividends shares in profits of partnerships taxed as corporations interest royalties prizes in. So if you are earning the minimum wage of Php 15000 you can have an additional take-home pay of Php 154183 per month under the 2018 tax reform. We are currently limited to computing the contribution for employed members only.

Before the enactment of this new law an individual employee or self-employed taxpayer would normally have to file an income tax at the rates of 5 to 32 depending on ones bracket. 1000000 falls under the 800000 lower limit bracket. The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2023 and is a great calculator for working out your income tax and salary after tax based on a.

Accordingly the withholding tax. National Tax Research Center. Future improvements will be.

Withholding Tax on Compensation in the Philippines. Income tax for Philippines is the individual income tax consists of taxes on compensation income from employment business income and passive income interests dividends. Basic amount will be 130000.

Husband PHP Wife PHP Gross income. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. Income tax in the Philippines is levied by the Philippine government on both personal and corporate income.

The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2021 and is a great calculator for working out your income tax and salary after tax based on a. Tax Calculator Philippines is an online calculator you can use to easily compute your income tax and other miscellaneous expenses that comes with it. The excess 200000 should be multiplied by 30.

Therefore 130000 60000 190000 tax due. As a member of Social Security System SSS this SSS Contribution Calculator will help conveniently compute your monthly contribution. Review the latest income tax rates thresholds and personal allowances in Philippines which are used to calculate salary after tax.

Philippines Income Tax Rates and Personal Allowances. Income Tax Calculator Philippines Who are required to file income tax returns Income tax law provided in Tax Code of 19997 governs income tax procedures in Philippines resident citizens. Taxable income Monthly Basic Pay Overtime Pay Holiday Pay Night Differential SSSPhilHealthPag-IBIG.

Income Tax Calculator For Philippines Check If Your Tax And Take Home Pay Is Correct Using Our Calculator Download It Now For Free By Excel Crib Facebook

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Hypotax Eca International

Taxable Income Formula Examples How To Calculate Taxable Income

Excel Formula Help Nested If Statements For Calculating Employee Income Tax

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Income Tax Calculation Formula With If Statement In Excel

Philippines New Tax Law Calculation Of Withholding Tax Steemit

Income Tax Katherine Uy Sobremonte

International Tax Planning Software International Tax Calculator

Lottery Tax Calculator Updated 2022 Lottery N Go

Bir S Official Withholding Tax Calculator

Excel Formula Income Tax Bracket Calculation Exceljet

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Income Tax Calculation Formula With If Statement In Excel

Interest Tax Shield Formula And Calculator Step By Step

Income Tax Formula Excel University

Philippines New Tax Law Calculation Of Withholding Tax Steemit